Marathon - Net Asset Value Update FEBRUARY 2024

SHARE PRICE & NET ASSET VALUE UPDATE – 29 FEBRUARY 2024

Marathon provides our Investment Partners access to our unique approach to investing. Our preference is to own a diverse group of assets that generate cash flows and provide an opportunity for capital appreciation with minimal risk of impairment. Marathon may hold meaningful amounts of assets in the safety of cash – patiently protected, whilst qualifying investments are being sought after.

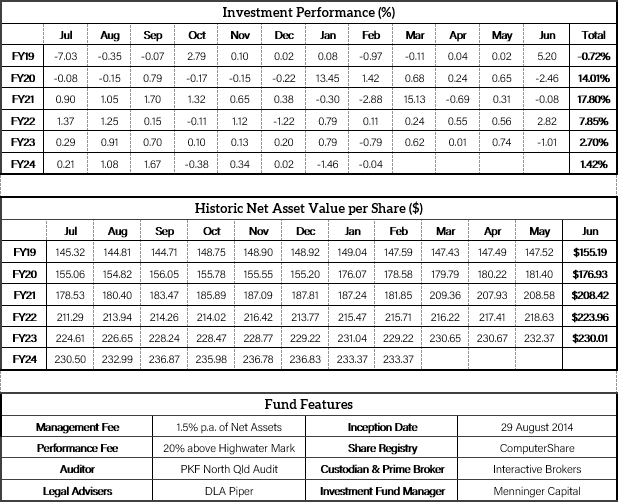

Important Information: Performance and analytics are provided only for the Net Asset Value of Marathon ordinary shares. Actual performance will differ for Investment Partners due to the timing of their investment. The 2015 & 2016 results are Not Meaningful (n/m) given the initial startup costs that Marathon incurred relative to its initial capital base, the increase in Net Asset Value Per-Share primarily relates to capital raised throughout the 2016 year. Returns are net of all fees.

About Marathon Consolidated Ltd

Marathon is a balance between an old-fashioned public company, private equity and a hedge fund. We utilise many of the same tools as private equity and hedge fund managers – investment analysis, investment activism and adaptive management. We view our portfolio as dynamic, reacting to opportunities as they develop.

However, unlike private equity firms we avoid excessive debt. Compared to hedge funds, we provide our Investment Partners with transparency. Above all we are focused on the preservation of capital and delivering investment returns over the long term - through investments with a margin of safety and a durable growing earnings stream.

Marathon’s investment manager is Menninger Capital. AFS License No. 455364

About Menninger Capital

Menninger manages exclusive global investment funds for private groups of investment partners who share our unequivocal long term value investment philosophy. Menninger is driven by passion to be a partner of world class businesses and its corporate advisory capabilities complement its investment management activities. As a partner, we act in a constructive manner to support management teams and boards in creating long lasting shareholder value.

Menninger Capital represents the investment management activities conducted by Menninger Capital Pty Limited or any of its subsidiaries. Clients will be provided Menninger Capital products or services by one or more legal entities that will be identified to clients pursuant to the contracts, agreements, offering material or other documentation relevant to such products or services.

For more information visit www.menningercapital.com or call +61 7 4728 8000.

We encourage you to think of investing as a long-term pursuit.

Important Information: This report has been prepared by Menninger Capital. This report is for distribution only under such circumstances as may be permitted by applicable law. It has no regard to the specific investment objectives, financial situation or particular needs of any specific recipient. It is published solely for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either express or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in the report. The report should not be regarded by recipients as a substitute for the exercise of their own judgement. Any opinions expressed in this report are subject to change without notice. The analysis contained herein is based on numerous assumptions. Different assumptions could result in materially different results. Menninger Capital is under no obligation to update or keep current the information contained herein. Past performance is not necessarily a guide to future performance. Estimates of future performance are based on assumptions that may not be realised.